Alta Vista Insurance Spreads Holiday Cheer with Boys & Girls Club of Vista’s “Adopt a Family” Event

At Alta Vista Insurance, we believe in the power of community and the joy that comes from giving back. This holiday season, we are excited to share our participation in the Boys & Girls Club of Vista’s “Adopt a Family” event – an initiative that brings warmth and happiness to families in need during this festive time.

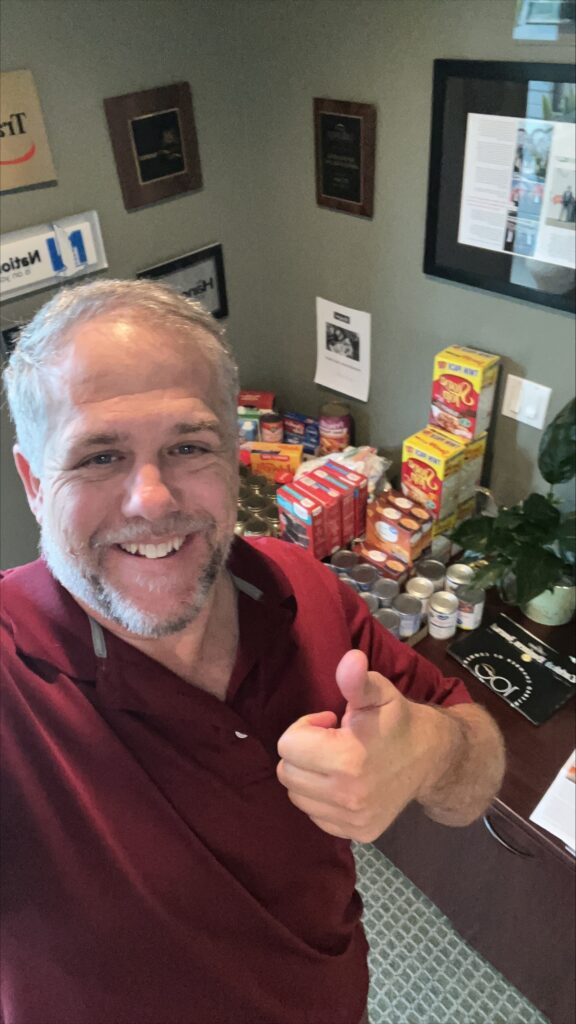

The Boys & Girls Club of Vista’s “Adopt a Family” project has become our annual tradition, and Alta Vista Insurance is thrilled to be part of this heartwarming initiative. Our commitment involves purchasing gifts for each child – clothing, toys, and gift cards. Additionally, we pledge to provide gifts and a gift card for each adult in the adopted family. For families that may need extra support, we contribute additional gifts to ensure a brighter holiday for everyone involved.

Seth Arruda, a proud member of the Alta Vista Insurance family, emphasized the significance of contributing to the local community during the holidays. “The holiday season is a time for gratitude, reflection, and above all, generosity. At Alta Vista Insurance, we understand the importance of giving back to the community that has supported us throughout the year. The ‘Adopt a Family’ event with the Boys & Girls Club of Vista is a wonderful opportunity for us to make a meaningful impact on the lives of those in need.”

To add a touch of warmth to the holiday festivities, we will also be providing a holiday meal gift card for each adopted family. This gesture aims to make their celebrations a bit brighter and more enjoyable during this special time of the year.

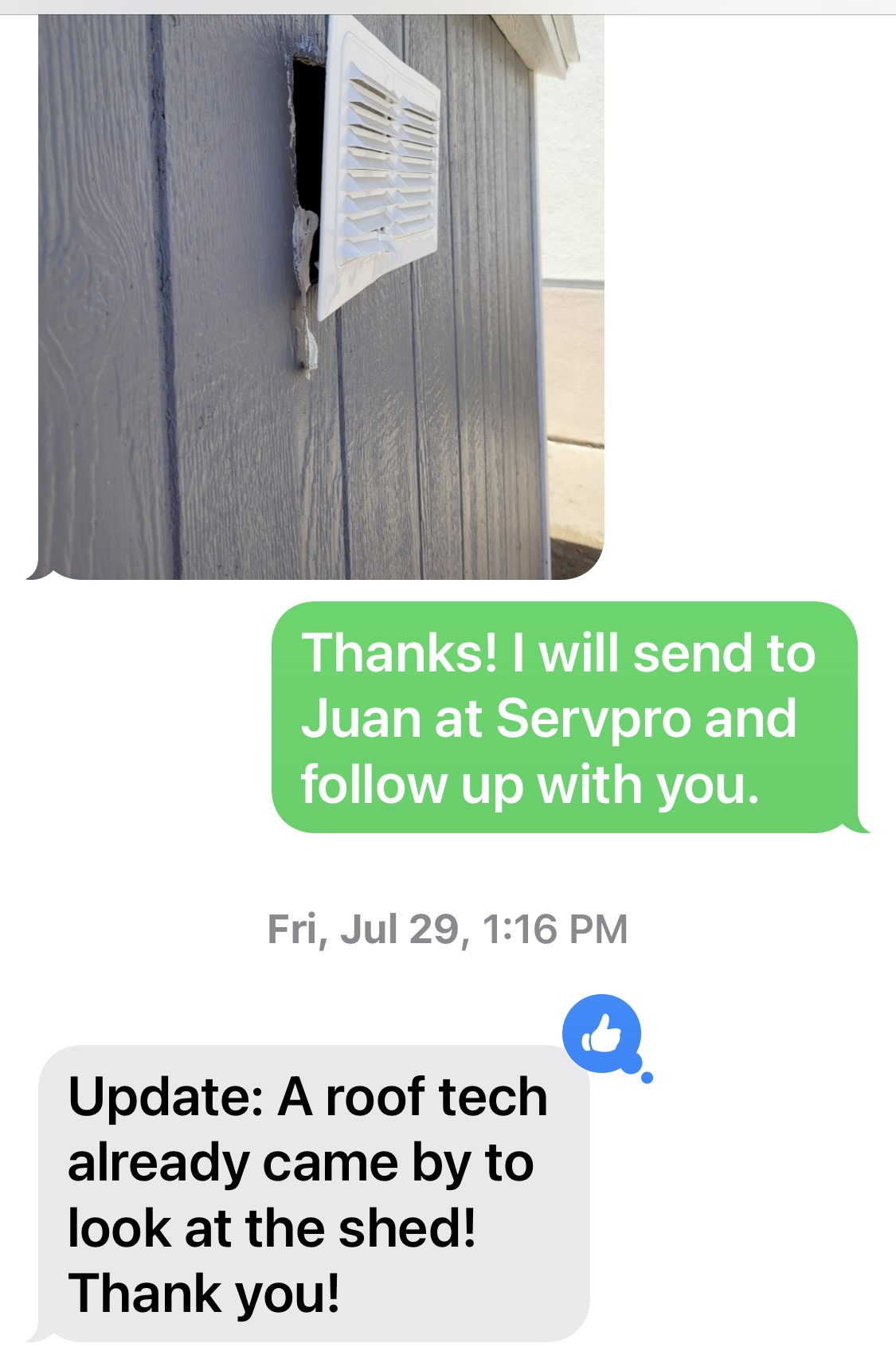

As we embark on this holiday community project, we invite our clients and community members to join us in spreading joy and goodwill. Together, we can make a positive impact on the lives of families in need and create lasting memories during this festive season.

In the spirit of giving, let’s come together and make this holiday season truly special for everyone. At Alta Vista Insurance, we believe that by supporting one another, we can create a community that thrives on compassion, kindness, and the joy of giving.

If you would like to contribute or learn more about our participation in the Boys & Girls Club of Vista’s “Adopt a Family” event, please feel free to reach out to us. Your support is invaluable, and together, we can make a difference in the lives of those who need it most. To learn more about the Boys and Girls Club of Vista visit their website here.